Unlock the power of Fintech marketing by learning how to create a customer-centric Fintech buyer persona. Read on to know the costs involved, where to get the data, the ideal tools to use, and how to create the ideal fintech buyer persona.

Table of Contents

ToggleCustomer-centric Marketing in the Digital Age

In modern digital marketing, especially for the Fintech industry, a buyer persona plays a critical role in identifying, attracting, and engaging potential clients for your products and services. Having a customer-centric buyer persona can give you the edge over your competitors as it provides a solid understanding of your prospective client’s profiles.

What is a Buyer Persona & Why is it Necessary

A buyer persona is a semi-fictional representation of your ideal customer. This representation contains valuable information about them, such as their age, location, demographic details, interests, ambitions, pain points, and previous buying habits.

Buyer personas allow you to effectively condense all your customers’ information to a single persona. (You aren’t limited to just one, though! If your company has multiple products or services, you can create multiple buyer personas). Fintech Buyer personas help you understand what your customers want and how you can optimize your Fintech services to fulfill their desires better.

The buyer persona is very effective in digital marketing in particular. It is one of the foundational elements for a great digital marketing strategy. Knowing your customers’ desires, pain points, and challenges can allow you to tailor your marketing content towards them. Speaking directly to peoples’ interests is a sure-fire way of converting leads to sales

Fintech companies serving a large consumer base in cut-throat competitive environments often find it hard to connect with and try to understand all of their customers individually; this is why Fintech buyer personas are so helpful.

How To Create the Ideal Fintech Buyer Persona

Creating a sound, detailed, and practical buyer persona is an elaborate process involving a lot of effort and research.

It’s important to know that even though the prospective customer in question is fictional, the persona should be based on real-world data. Their needs, ambitions, pain points, and interests must be realistic and give you an actionable strategy.

Research, Research & More Research….. (and Research Some More)

Conducting thorough research is the first step in gathering accurate and valuable data about your prospective customers. Collect the primary demographic and psychographic data such as their age, interests, spending habits, challenges, stage of life, and financial position.

Additionally, keep these thoughts in your head while gathering and compiling the information:

- Who would want to buy from you and why?

- Aside from your prospective client, who else is involved in the purchase decision-making process?

- What information do they need to make informed buying decisions?

To get this information, use customer analytics from sources such as:

- Brand’s social media analytics.

- Google-analytics.

- Your customer database.

- Listening to interviews and customer feedback.

- Engaging your sales, marketing, and customer relations department. Consider their thoughts.

- Customer satisfaction and feedback surveys.

However, If you’re a part of a new company or a startup with a small customer base, trying to utilize existing customer data could be impractical and may prove ineffective. (due to the small sample size).

Here are some more data sources that don’t require you to have an existing customer base:

- Utilizing market research tools & platforms

- From US business census data to open source softwares such as R studio and tools like make my persona, market research tools are a great arsenal for Fintech startups to gather data, analyze it and create useful buyer personas. Most of these market research tools are either free to use or come with an ample trial period.

- Purchasing data from established data providers

- This is especially effective for obtaining demographic, browsing/media consumption habits and purchasing data.

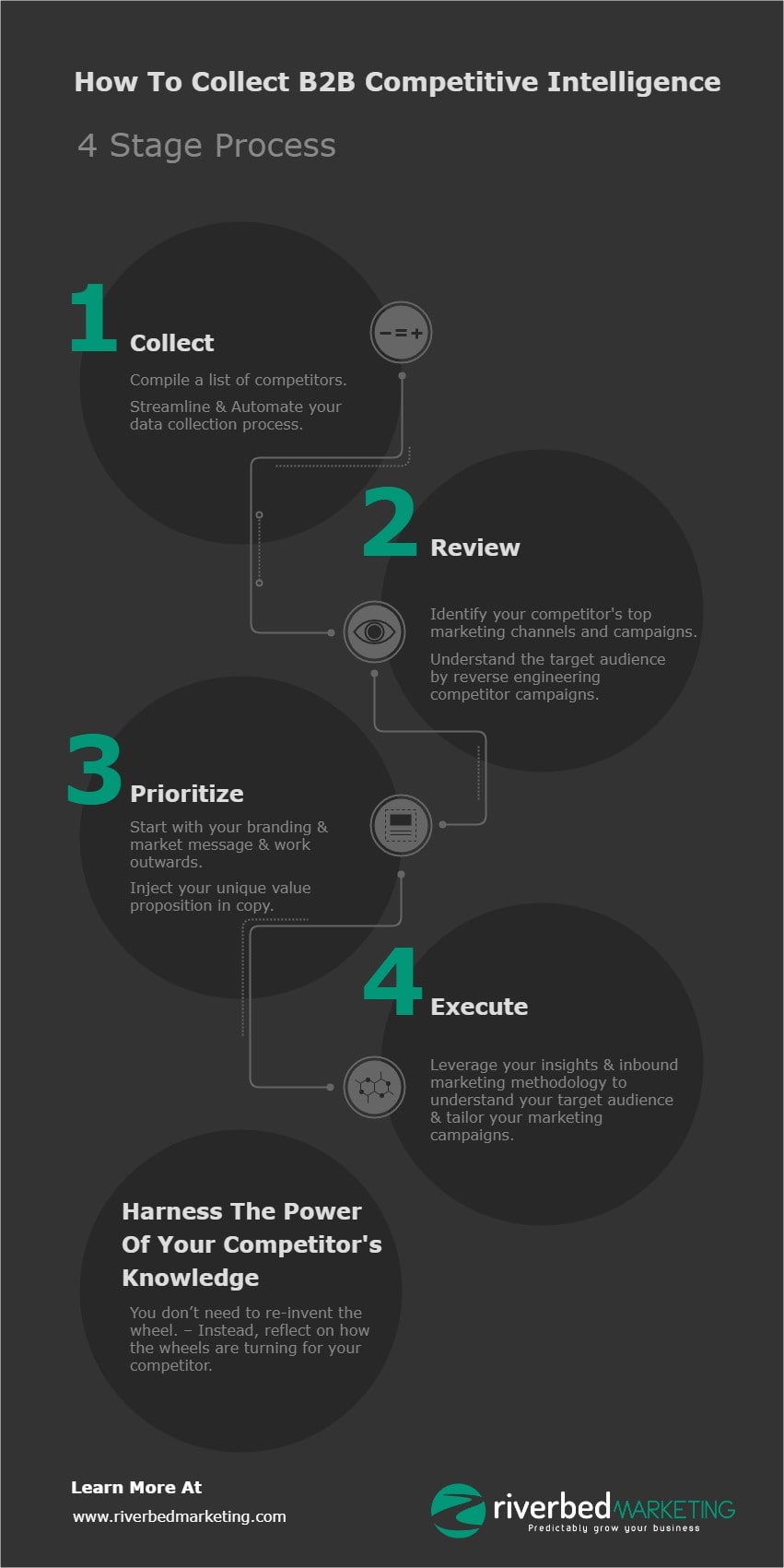

- Conducting competitor research

- Use resources such as whitepapers, their socials, and their publications to find out what consumer pain points they are trying to address.

- Keeping up with industry news and trends, as well as listening to prominent speakers within the industry

- This can provide you with valuable insights on the customer pain points that are commonly targeted within the fintech industry, customer habits, and updates in the technological sector.

- Reviewing customer testimonials and reviews on products/services similar to yours

- Find out what makes a product/service great. Understand how it helped the customer from their perspective. This is valuable information to add to the challenges and goals section of the buyer persona.

- Interviewing people with similar interests from third-party networks such as UserTesting.com.

If your target market consists of businesses, gather information like the size of the business, key decision-makers, and why they need your product. Again, the internet is an excellent place to obtain information about companies.

Create a Buyer Profile

It is not enough to collect the data, turn it into actionable information by creating the buyer profile. Mention their details as you would in a profile, and write a brief (can be as long as you need, but it has to be to-the-point) description of your customer. You can choose to give your ideal buyer a name (purely for convenience).

Appeal to Your Persona’s Goals, Challenges & Pain Points

This is arguably the most critical aspect of the fintech buyer persona. You want to be as thorough with this as possible. Understand what your buyer’s end goals and ambitions are. Understand what prevents them from achieving these goals and ambitions and how your product/service can help them with their challenges and allow them to realize their goals.

How to Validate a Marketing Idea

There are several approaches you can take to validate your Fintech marketing idea. Starting with the obvious, you can ask your peers and colleagues for feedback; Listening in on customer interviews can also be an excellent way to judge whether they would be interested in the new idea or not. Another effective method to check whether your marketing idea would be practical or not is to research the search volume of terms related to your idea. This should give you insight whether demand exists for your idea. Competitor research can also be a viable method to judge what works in marketing and what doesn’t. See what strategies your competitors are using and whether it’s working or not.

Lastly, you can also interview your customers or clients directly to determine what they think. This will provide you with the most organic and raw form of feedback.

The Best Tools for Creating a Buyer Persona

I’ve mentioned the basics, but how exactly do you create one? What is the format supposed to be like? What information goes where?

It can seem confusing, but this is where templates and tools come in. There are many free and paid resources available online that can help you collect and organize information and then use it to create a buyer profile.

As an example, Make My Persona by Hubspot is a great interactive tool that can make your fintech buyer persona for you.

The Future of Fintech Marketing

The Fintech industry has seen tremendous growth in recent years and has no signs of slowing down. The sector, now worth 210.1 Billion dollars, has seen widespread adoption of cloud computing to increase efficiency, artificial intelligence to automate tasks, Blockchain to increase security and decentralize transactions, among other revolutionary technologies.

Additionally, refinement in Fintech services has improved the convenience and user experience, bolstering consumer confidence in fintech services, poising the industry for further expansion.

As users and investors gain trust in the Fintech sector, there will be a greater audience to market to, making the need for buyer personas now more important than ever.

What is the Average Cost per Lead in Fintech?

The finance and technology industries usually have higher average costs per lead than average. However, the costs are declining as digital marketing improves. The average cost per lead in 2020 for the financial services industry was only $47, compared to $160 in 2018. This further underscores the need to be ever more agile and efficient with your marketing spend. Focusing on marketing verticals that provide high ROI is a requirement.

AI in Fintech Marketing

AI is already a critical part of the fintech industry in its operations. It plays an integral role in data analysis, risk assessment, wealth management, and cybersecurity. In marketing, AI plays a significant role in marketing automation – a process by which several repetitive tasks of the marketing campaign are carried out automatically by computers and AI. These can include:

- Lead generation

- Sending emails, SMS, and messages

- Social Media management

- Fintech customer service and support

- ROI tracking

- Survey and feedback messages

AI streamlines the data aggregation process and makes it easier, faster, and less complex to build a spot-on buyer persona.

If this all seems too dauting, don’t feel overwhelmed. Riverbed is deeply steeped in the FinTech industry and ready to do the heavy lifting. From strategy to execution, Riverbed’s turnkey approach to digital FinTech marketing drives high quality leads at an RIO that makes sense. Don’t hesitate to reach out for your free, no obligation, assessment to see how we can help your business today!